When Tesla unveiled the Roadster to the public in 2006, it triggered a series of events that changed the automotive world forever. Currently, the electric vehicle race isn’t about the fastest cars – EVs have proven to be faster while being more efficient. The battleground is over battery technology, vehicle range, in-car tech, manufacturing costs, and the advancement of the charging ecosystem.

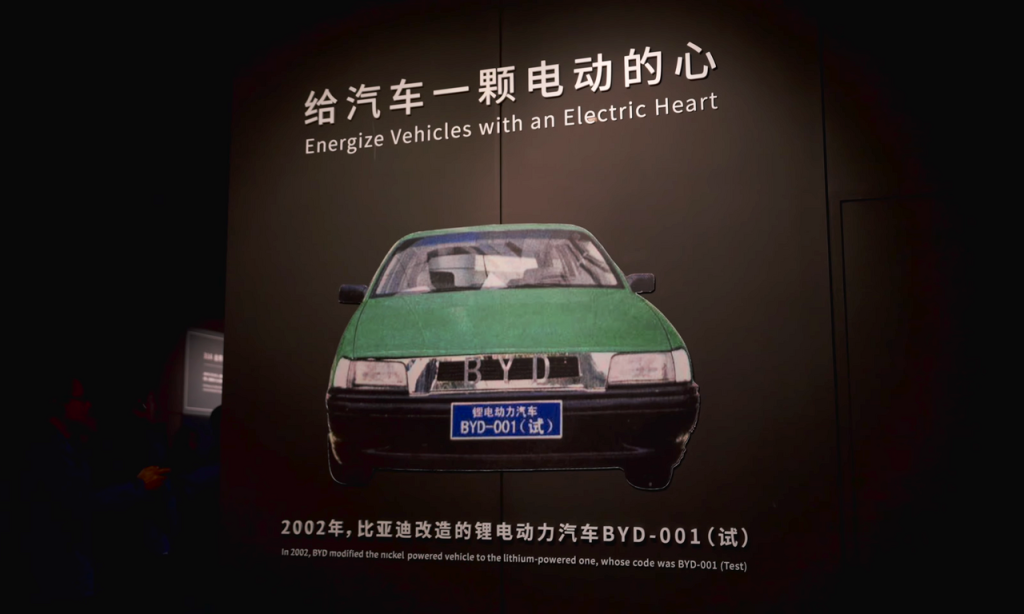

Tesla took the leap of faith and initiated the electric vehicle revolution – and for a minute, it was a one-man show. But other players joined in. It’s easy to think the biggest Tesla competitor would have been legacy automakers like Ford, GM, or VW. Interestingly, the biggest competitor to the Austin-based automaker in the electric vehicle market is Chinese battery maker-turned EV automaker BYD.

In the fourth quarter of 2024, BYD overtook Tesla as the world’s top EV seller by employing a range of strategies from offering more affordable and diverse models to cutting costs through vertical integration and in-house battery production – all while capitalizing on its home market in China. But how exactly did the Chinese EV maker pull it off?

Battery Technology

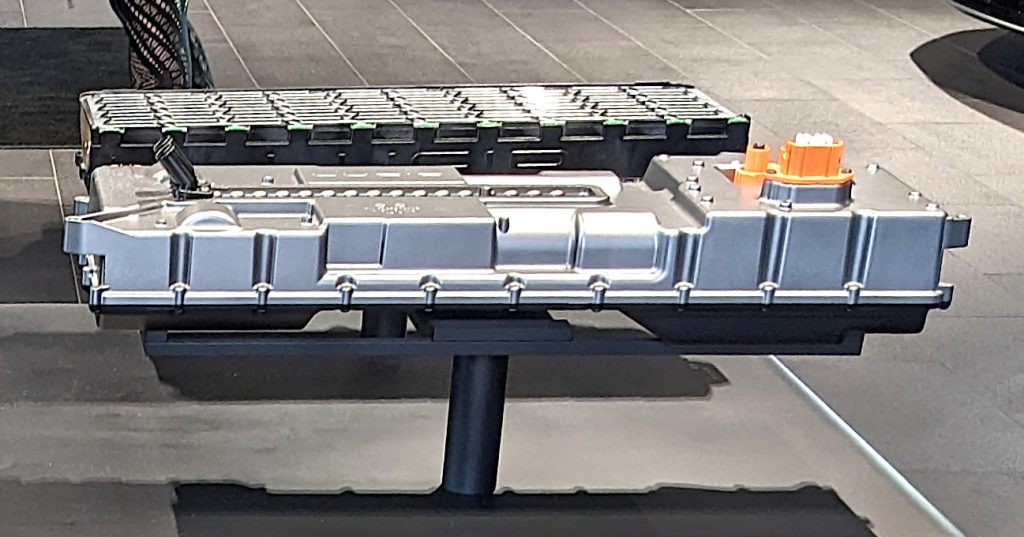

Battery technology lies at the heart of the electric vehicle industry. Often considered the holy grail, it directly addresses range anxiety, which has long been the biggest hurdle for first-time EV buyers. Electric vehicle batteries also directly affect the performance and overall cost of an electric vehicle. Interestingly, BYD was initially a battery manufacturer and leveraged its expertise to develop the Blade Battery technology, which utilizes Lithium Iron Phosphate (LFP) chemistry. This chemistry is safer, cheaper, and longer-lasting compared to the nickel-cobalt ternary batteries used by Tesla in its EVs.

Tesla initially held the lead with its Supercharger network, but BYD has narrowed the gap with its new Super e-Platform 3.0 (1000 kW megawatt charging)— an ultra-fast charging system that adds significant range in minutes, helping reduce range anxiety in new users.

Heat is one of the biggest challenges in fast-charging. To overcome it, BYD lowered the battery’s internal resistance and used advanced power chips (silicon carbide) that can handle high voltages and currents without generating excessive heat. Experiments conducted on the competing batteries revealed that BYD batteries have better thermal management compared to Tesla’s 4680 cell. Additionally, unlike Tesla, BYD controls its entire battery production process, from raw materials to finished products, which significantly reduces overall production costs. This is a huge advantage for BYD over Tesla, as the company that can produce batteries more cost-effectively without compromising quality ultimately wins.

Affordable EV offerings

For the longest time, Tesla’s primary strategy was a premium-first approach, focusing on high performance. BYD’s strategy, on the other hand, was focused on manufacturing low-cost models, such as the ultra-cheap Seagull hatchback. As such, the Chinese automaker offered an entry point into the EV market – something that Tesla still can’t match. This, in turn, appealed to a broader market segment, taking over the budget-friendly EV and hybrid segments – especially in its home country, China.

BYD’s product line often starts at a significantly lower price, as low as $10,000 in some markets, which is cheaper than the average price of a conventional car. Currently, the cheapest gas-powered car in the U.S. is the Mitsubishi Mirage G4, which has an MSRP of $16,695 – significantly less than the most affordable Tesla (Model 3 Rear-Wheel-Drive), which costs approximately $38,000 (before tax incentives).

This strategy has allowed BYD to capture a broader, more price-sensitive market, not only in China, but also abroad among younger drivers. The ripple effect has been significant; high-volume production drove down battery costs, which BYD later applied to its passenger cars, making these Chinese electric vehicles so cheap.

Chinese government incentives

It helps a lot when your government is behind you, especially when you are a car manufacturer. Tesla has greatly benefited from the U.S. government through tax cuts and funding. Still, the Chinese government, through incentives, has significantly contributed to BYD’s rise over Tesla by offering substantial subsidies, tax breaks, and favorable financing, which significantly lowered the cost of production and ultimately made electric vehicles more affordable to consumers.

BYD also benefited from below-market equity and debt financing, which offered crucial capital for scaling up production, fueled research and development, and boosted domestic demand for EVs in China.

Chinese government incentives also helped stimulate the demand for EVs, making China the world’s largest EV market. This, in turn, created a protected and competitive domestic market that helped BYD’s rapid growth into the world’s largest EV manufacturer. Looking back, the Chinese government saw high-tech products like EVs as a chance to revive its economy. This reasoning drove strategic investments and support for companies like BYD, helping to achieve its national goals.

Aggressive global expansion

Although China was the largest car market in the world and BYD had a home country advantage, the electric vehicle manufacturer still pursued an aggressive global expansion plan. This move not only helped the Chinese EV maker establish an international brand presence but also helped it overtake Tesla by gaining a stronger foothold in emerging markets.

BYD also developed manufacturing plants in key target markets, such as Brazil, Thailand, and Hungary, to lower costs and avoid import duties, thereby serving the local market more effectively. It also established research and development infrastructure centers in these locations to cater to the needs of these emerging locations. According to an article by the Economic Times, the EV maker also prioritized expansion into these emerging markets where Tesla had a less significant presence.

If you are introducing a new product, such as an automobile, into an emerging market, it would also benefit the region if it has access to after-sales services, maintenance, and locally available replacement parts. BYD invested in controlling its export logistics by purchasing cargo ships and establishing overseas parts warehouses in regions such as the Netherlands, aiming to improve after-sales services and address past weaknesses associated with its expansion into international sales.

Diversified product portfolio

Tesla’s primary focus is on a limited premium offering; BYD, on the other hand, is determined to capture the entire market, much like a full-blown automotive outfit. As such, the Chinese EV maker didn’t just focus on making affordable electric vehicles, but ensured that it had diverse offerings across the range, from budget-friendly models to luxury sub-brands.

BYD strategically offers a diverse range of EVs, which include both affordable options, such as the Seagull hatchback, and high-end models under sub-brands like Denza and Yangwang. This helps compete and appeal to a broader client base compared to Tesla’s focus on a premium product line. Furthermore, BYD also produces hybrid vehicles in addition to battery-electric vehicles, a key differentiator that makes them quite popular in markets like China.

How is this beneficial? Well, it generates multiple revenue streams, boosting market resilience, and lets BYD use its integrated supply chain to keep costs low, making its cars more appealing to the mass market. By making its offerings more diverse and affordable, the Chinese EV automaker has established a dominant presence in its home market, which not only boosts its overall production volumes but also improves its global influence.